Economy in Uganda

The impact on economy and tourism for first host city of the League of Legends European Championship finals

The impact of Covid-19 on the E-Sports

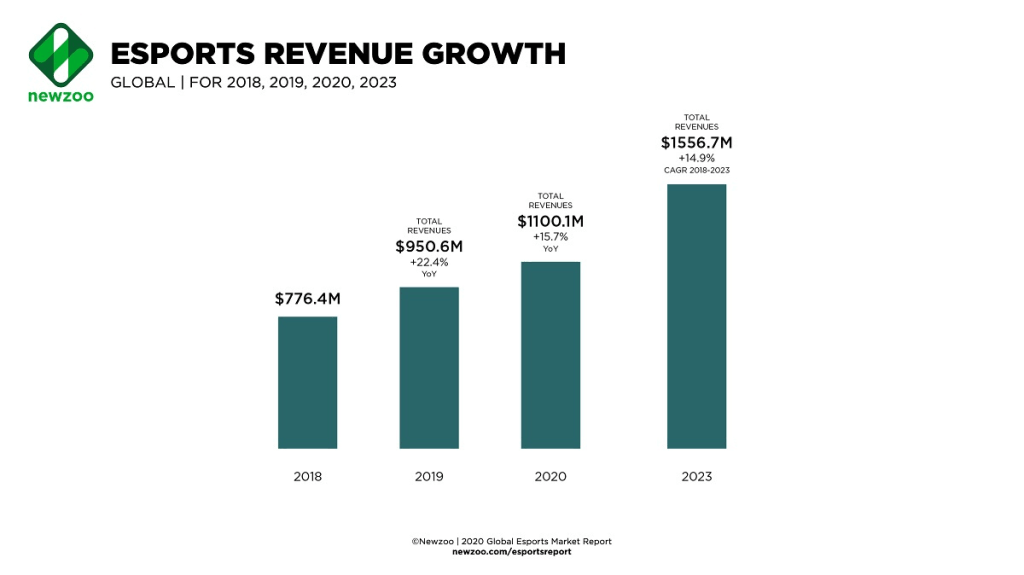

The global esports market is now estimated to generate revenues of US$1.05 billion in 2020, according to Newzoo, down from the market researcher’s previous estimate of US$1.1 billion.

The Global Esports Market Report has also adjusted its 2023 forecast upwards slightly, with the competitive gaming industry now set to generate revenues of US$1.59 billion, compared to US$1.55 billion.

The biggest contributing factor to Newzoo’s revision is the coronavirus pandemic, which has caused many esports events to be postponed, cancelled, or moved to online formats. The new report stresses that its update is not to do with decreased demand or decreased supply.

As a result, the temporary cease in esports activity and a transition to digital-only events saw 2020’s projections affected. After this year, the immediately impacted revenue streams will remain unchanged from Newzoo’s previous forecast.

Breaking down the impact of Covid-19 on esports in 2020, income from merchandise and ticket sales is projected to fall from US$121.7 million to US$106.5 million. Newzoo has also downwardly revised media rights and sponsorship forecasts for this year, going from US$185.4 million to US$176.2 million and US$636.9 million to US$614.9 million, respectively.

Despite those shortfalls, as well as the cancelled and postponed events, Newzoo expects streaming revenues to grow faster than expected. The global quarantine has led to higher viewership across various over-the-top (OTT) platforms, meaning team streaming revenues are set to increase from US$18.2 million to US$19.9 million in 2020, and US$31.6 million to US$34.4 million in 2023.

Global partnership fees for 2020 are also expected to rise to US$120.2 million this year. This is based off a steady flow of new competitions, titles, and publishers leading to more demand, thus driving up publisher fees, even in more mature markets such as North America, China, Europe and South Korea.

Newzoo adds that it remains confident that esports will continue to be an attractive business or marketing opportunity for publishers, and that this growth will be sustainable for the coming years in both developed and developing markets.

In addition, Newzoo expects to make further downward revisions to its forecasts if the coronavirus outbreak impacts the second half of 2020.

The report does not factor in the impact of a potential global recession resulting from the decreased economic activity caused by Covid-19. It does, however, warn that the negative impact on consumer-brand spending in esports could hurt the growth of both sponsorship and media rights revenues.

How eSports has become a global phenomen

E-what?

eSports (short for Electronic Sports) is the name given to professional competitive gaming. In a nutshell, competitors play video games, while being watched by a live audience. Millions more watch the games online.

One major tournament, the 2016 League of Legends World Championship finals, attracted 43 million viewers.

Global esports revenues will surpass $1 billion in 2020 for the first time — without counting broadcasting platform revenues, according to market researcher Newzoo.

‘Esports’ impressive audience and viewership growth is a direct result of an engaging viewership experience untethered to traditional media,” says Newzoo chief executive Peter Warman. “Plenty of leagues and tournaments now have huge audiences, so companies are positioning themselves to directly monetize these Esports Enthusiasts. While this began happening last year, the market is constantly expanding on its early learnings.

Investment is the Driver

Endemic and non-endemic brand investments (media rights, advertising, and sponsorship), the report says, will make for 82 per cent of the total market. The highest-grossing individual esports revenue stream worldwide is sponsorship, generating $456.7 million in 2019. The fastest-growing esports revenue stream by far is media rights, it adds.null

Besides non-endemic brands, digital broadcasters and TV media companies have already started to compete for esports content and the extent to which these deals will generate a direct return on investment will impact the pace of media rights growth. Other ongoing developments that have high revenue potential include increased esports franchising, new content formats and premium passes, the success of mobile gaming, team profitability, and the success of new focus on professionals and streamers as brands.

Considering the current growth, Newzoo estimates the esports market will reach $1.1 billion by 2020. If any of these factors accelerate, a more optimistic scenario places revenue at $1.5 billion by 2023, it says.

The China Effect

As per the report, China will generate $210.3 million in revenue this year, overtaking Western Europe as the second-largest region in terms of revenue. The country is notable for the growing popularity of mobile esports, including casual titles.

„North America, meanwhile, will once again be the largest esports market, with revenue of $409.1 million. The report predicts that it will show strong growth toward 2022, reaching $691.1 million. The largest share of North America’s 2019 esports revenue will come from sponsorship, at $196.2 million. Meanwhile, media rights will contribute most to this growth and will remain the fastest-growing and second-largest esports revenue stream in the region.